Behavioural AI for Student Finance

Predict academic success and loan repayment using AI-powered behavioural assessment technology

Science-Backed Behavioral Psychology

Leveraging 10+ years of longitudinal classroom data and career/job fit algorithms.

AI Powered Assessment and Prediction

Assessing likelihood to repay loans, course completion, and future earning potential.

For Thin-File, No Credit History Applicants

Serving people with no credit history through inclusive, ethical, and dynamic methods.

Many academically capable young people are excluded from higher education because they fall into the "missing middle" or have too little credit history for lenders to assess risk.

Adults lacking formal credit records

Lower enrollment due to credit constraints

Average Year 1 dropout rate

Average extended study periods

Our predictive models help lenders reduce defaults, HEIs reduce dropout rates, and students get matched to the right programs from day one.

AXCESSR uses behavioral psychology, AI scoring, and 10+ years of student-outcome data to evaluate course fit, repayment likelihood, course completion, and future earning potential - even for thin-file applicants.

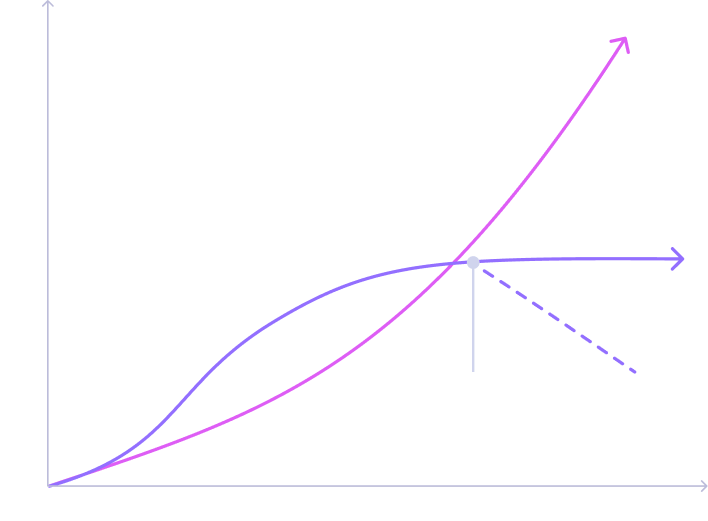

The Predictive Power of Credit Scoring Models

Gini Coefficients

Predicts ability to repay

Predicts ability to repay

Yields superior results

How it works

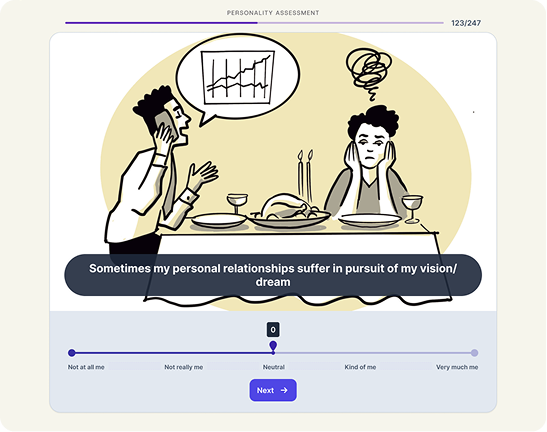

Data Collection & Behavioral Assessment

Individuals complete a 15-minute AI-powered behavioral assessment capturing personality, values, academic attitudes, career fit, and situational responses - combined with academic history and biographical inputs.

AI Scoring & Risk Modeling

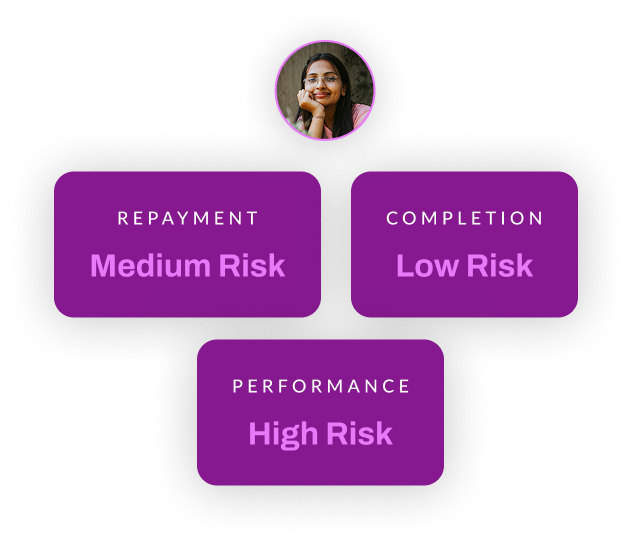

Our models calculate completion risk, repayment likelihood, career alignment, affordability and behavioral fit. Thin-file applicants receive synthetic scores using limited data.

Real-Time Routing & Placement

AXCESSR generates tailored reports for lenders, HEIs, bursaries, and applicants. High-potential students are routed into the right courses, opportunities, and funding partners. Institutions and lenders integrate via API or use the marketplace to access pre-profiled talent.

Our Solution

Behavioral Risk Intelligence

Predict repayment, completion, and performance using AI-backed psychometric science.

Predictive Gini 0.28-0.31 using behavioral data alone (credit risk)

Provides risk scores even for thin-file applicants

Reduces financial losses from defaults and non-completion

Enables confident lending and bursary allocation

Why Axcessr

Deep psychometric assessment

Calibrated specifically for student success (not generic creditworthiness)

Education finance focus

From day one (not adapted from other lending)

Longitudinal validation

With 10+ years tracking students from enrolment to career

Platform advantage

Serving students, lenders, AND institutions creates switching costs

Want to Learn More?

Book a demo to see how Axcessr can benefit your business